AVIAT NETWORKS (AVNW)·Q2 2026 Earnings Summary

Aviat Networks Q2 FY2026 Earnings: Crushes Estimates, Record Bookings

February 3, 2026 · by Fintool AI Agent

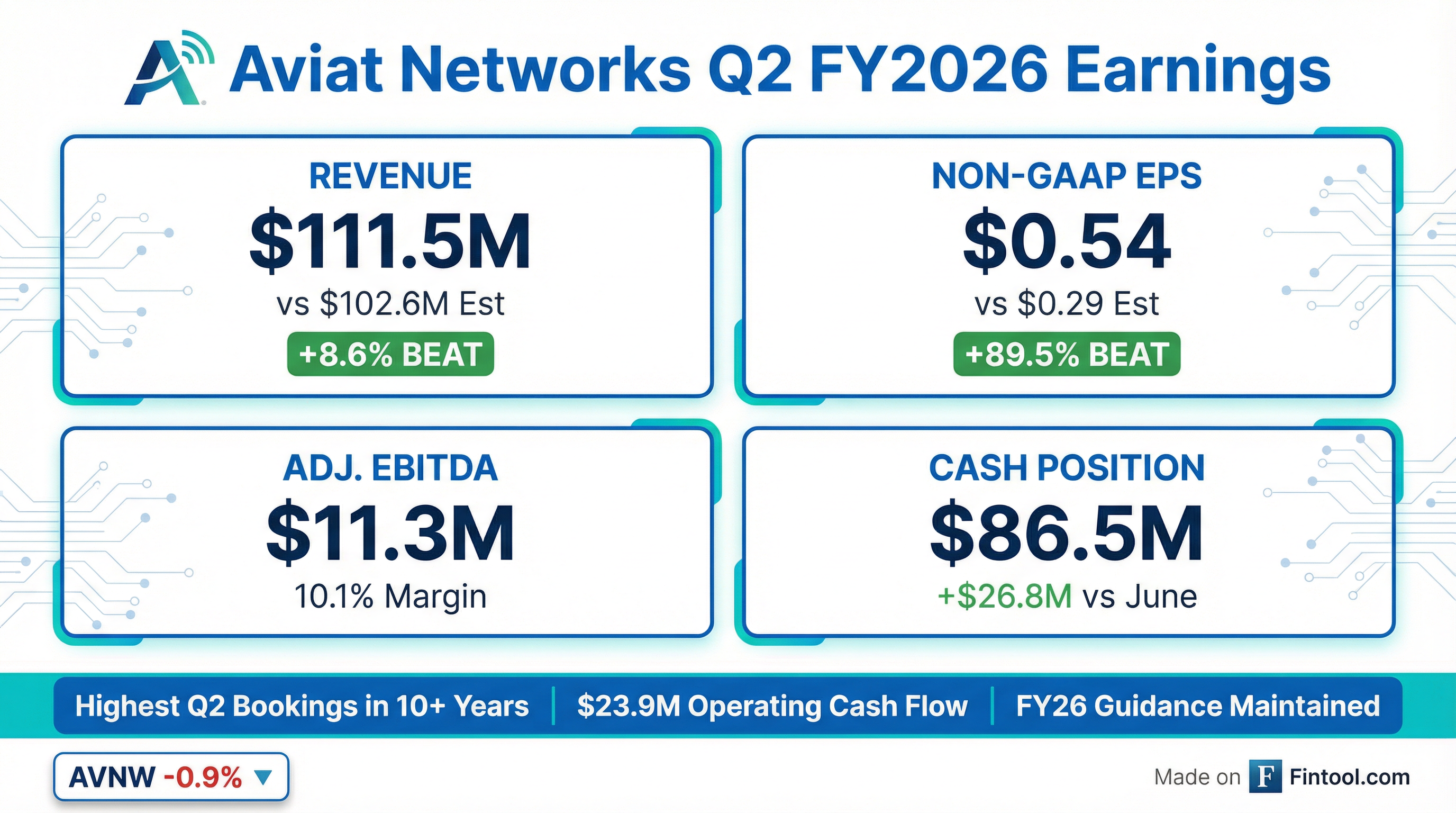

Aviat Networks (NASDAQ: AVNW) delivered a standout Q2 FY2026, crushing consensus estimates on both revenue and earnings while achieving its highest second-quarter bookings in over a decade. Revenue of $111.5M beat the Street by 8.6%, while Non-GAAP EPS of $0.54 nearly doubled consensus expectations of $0.29. Despite the strong beat, shares closed down 0.9% at $22.43 as investors weighed YoY margin compression against the record bookings momentum.

Did Aviat Networks Beat Earnings?

Decisive beat on both lines. Aviat delivered revenue of $111.5M versus consensus of $102.6M (+8.6%) and Non-GAAP EPS of $0.54 versus $0.29 (+89.5%). This marks the company's sixth consecutive quarterly beat after a brief miss in Q1 FY2025.

The story behind the beat: Strong execution across private networks and timing of mobile network projects drove the upside. The company generated $23.9M in operating cash flow—an exceptional quarter for a $280M market cap company.

What Changed From Last Quarter?

Sequential improvement from a soft Q1 FY2026. Q1 was a transitional quarter with lower revenue ($107.3M) and compressed margins. Q2 demonstrated the company's ability to recover momentum.

Key developments this quarter:

- Record bookings: Highest Q2 bookings in over a decade signals strong pipeline

- Tier-one win: Secured initial purchase order from a U.S. tier-one operator for the multi-dwelling unit (MDU) solution

- Balance sheet strength: Net debt reduced from $41.7M to $18.9M

- Working capital improvement: Unbilled receivables down $20.1M to $90.6M

What Did Management Guide?

Guidance maintained. Despite the strong Q2 performance and record bookings, Aviat left its full-year FY2026 guidance unchanged:

Reading between the lines: The conservative guidance stance despite record bookings suggests management is building in buffer for potential timing variability in large private network and mobile operator projects. The implied H2 trajectory shows revenue acceleration and margin expansion to hit the full-year targets.

Margins and Profitability Trends

YoY margin compression, but well above year-ago first half. GAAP gross margin of 32.4% was down 220bps versus Q2 FY2025 due to unfavorable regional and product mix. However, first-half FY2026 margins of 32.8% are up 340bps versus the first half of FY2025.

Operating expense discipline: R&D expenses dropped 37% YoY to $6.4M (5.7% of revenue), down from $10.2M (8.6% of revenue) as the company streamlined operations post-acquisitions.

Geographic Performance

North America soft, international resilient. The revenue mix shifted slightly toward international markets this quarter.

Revenue mix (Q2 FY26): North America 48%, International 52%

The North America decline was attributed to timing of certain private and mobile network projects, not structural demand weakness.

Balance Sheet Highlights

Cash generation machine. Aviat's balance sheet strengthened materially this quarter:

NOL shield remains valuable: Over $460M in gross net operating losses will reduce the effective cash tax rate to ~5% versus the statutory ~25% for the foreseeable future.

What Did Management Say in Q&A?

On the record bookings: CEO Pete Smith emphasized the significance: "This is the highest bookings level we've had in 10 years, and the reason we didn't go back further is 'cause we couldn't find the data." Book-to-bill was confirmed "over 1" for the quarter, driven by both service providers and private network business.

On what's in guidance: Smith provided color on what's embedded in the $440-460M revenue outlook: "De minimis on the 5G router, zero on BEAD, and a little bit on the MDU project." This signals meaningful upside potential if any of the three organic growth initiatives materialize faster than expected.

On BEAD timing: The company is "getting more and more bullish" on BEAD, with Smith expecting it to materialize "sometime between July and December of 2026." Fixed wireless access is capturing 10-15% of BEAD locations, which typically correlates to wireless backhaul rather than fiber.

On cellular router progress: Aviat received its first PO and is now engaged with approximately 15 customers. Smith noted: "We haven't had any customers who said, 'No, this doesn't make sense.'" Expects this to become material "sometime in fiscal year 2027."

On MDU opportunity: The tier-one MDU win is "progress, not necessarily a needle mover" yet. Smith indicated: "The time to get excited about the MDU project would be if hopefully we win the next order. That would make a difference in our backlog, and we'd probably be forced to raise our guidance."

On capital allocation: The company has ~$6.5M remaining on its buyback authorization and "anticipates turning the buyback back on" following board discussions earlier in the week.

On Europe strength: The region's 37% YoY growth was attributed to a new EMEA leader hired ~5 quarters ago who is "driving tremendous discipline and key focus on private networks."

How Did the Stock React?

Muted despite the beat. AVNW closed down 0.9% at $22.43 on the day of earnings despite the double beat. The stock had run up 4% in the prior session, suggesting some buy-the-rumor, sell-the-news dynamics.

Context: At $22.43, AVNW trades at roughly 0.6x LTM revenue ($447M) and ~5x the midpoint of FY26 EBITDA guidance ($50M). For a company with record bookings, no net debt concerns, and improving profitability, the valuation appears undemanding.

Key Catalysts to Watch

-

MDU solution deployment: First U.S. tier-one operator deployment of the multi-gigabit 5G-based MDU solution could drive material follow-on orders

-

Cellular router market entry: $1.6B TAM growing at 12% CAGR represents a new addressable segment for Aviat

-

BEAD program spending: $42.5B in federal rural broadband funding creates tailwinds for wireless transport solutions

-

Private LTE/5G adoption: Private network market expected to reach $8B by 2027 with Aviat well-positioned

-

5G transport cycle: Microwave radio market for global 5G transport expected to grow at 16% CAGR through CY2028

Bottom Line

Aviat delivered a clean beat-and-meet quarter—crushing estimates while maintaining conservative guidance. The record Q2 bookings signal strong underlying demand, and the tier-one MDU win opens a new growth vector. YoY margin compression is a watch item, but first-half trends show the business is on solid footing. The muted stock reaction creates an interesting setup for investors who believe the bookings strength will convert to sustained revenue growth.